BT Question Set P1-T2-20-25: Long-horizon forecasts

T2-20-25

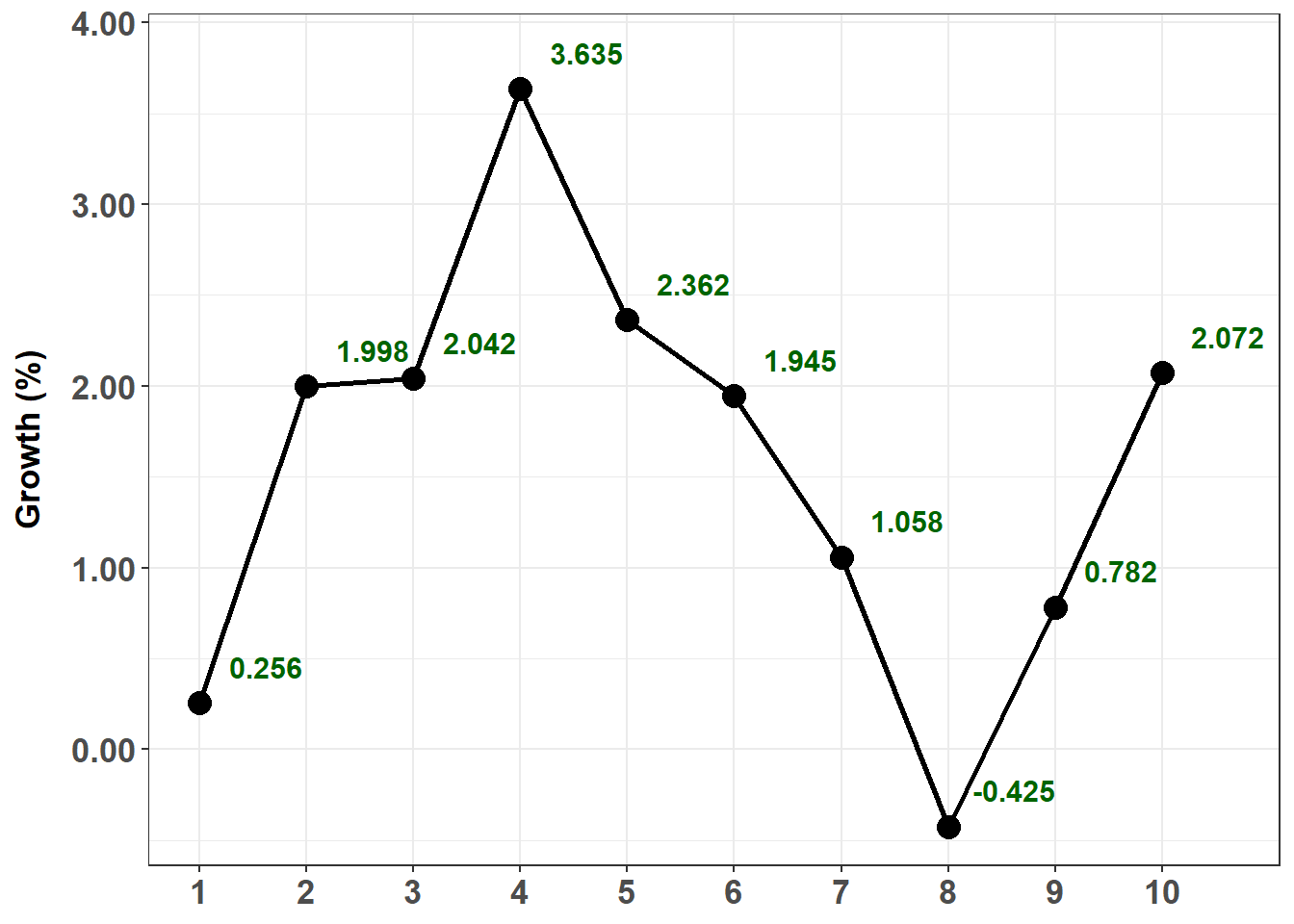

20.25.1. Over the prior ten months of the calendar year, below is plotted the monthly growth rate of a new cryptocurrency. Two months ago, the growth rate was + 0.782%. Last month, the growth rate was +2.072%. We will omit the percentage symbol (%) and assume the growth rates are percentages; i.e., Y(9) = Y(t-2) = +0.782 and Y(10) = Y(t-1) = +2.072.

*** plot goes here ***

Your colleagues have determined that the best model for this series is an AR(2) model which is given by Y(t) = ẟ + ϕ(1)Y(t-1) + ϕ(2)Y(t-2) + ε(t). In this instance of the model, the intercept is 0.40, the first AR parameter is 0.50 and the second AR parameter is 0.30; specifically, the model is given by Y(t) = 0.40 + 0.50Y(t-1) + 0.30Y(t-2) + ε(t). Please note that the intercept of 0.40 here represents 0.40% such that, in decimal terms, the model is given by Y(t) = 0.0040 + 0.50Y(t-1) + 0.30Y(t-2) + ε(t) where Y(t-2) = 0.007820 and Y(t-1) = 0.020720 but the AR parameters remain 0.50 and 0.30.

library(tidyverse)## -- Attaching packages --------------------------------------------------------------------------------- tidyverse 1.3.0 --## v ggplot2 3.3.2 v purrr 0.3.4

## v tibble 3.0.3 v dplyr 1.0.2

## v tidyr 1.1.2 v stringr 1.4.0

## v readr 1.3.1 v forcats 0.5.0## -- Conflicts ------------------------------------------------------------------------------------ tidyverse_conflicts() --

## x dplyr::filter() masks stats::filter()

## x dplyr::lag() masks stats::lag()set.seed(13)

AR_param_1 = 0.5

AR_param_2 = 0.3

AR_intercept = 0.4

AR_n <- 10

AR_LR <- AR_intercept/(1- AR_param_1 - AR_param_2)

theme_set(theme_bw())

# arima.sim model c(p, d, q)

# p = AR order

# d = difference

# q = MA order

# Generate an AR(2) with parameters, AR_param_1 and AR_param_2

# Not this: AR <- arima.sim(model=list(order=c(2,0,0), ar = c(AR_param_1, AR_param_2)), n = AR_n) + AR_intercept

AR <- arima.sim(model=list(order=c(2,0,0), ar = c(AR_param_1, AR_param_2)), n = AR_n, mean = AR_intercept)

AR <- round(AR, digits = 3)

AR_tb <- AR %>% as_tibble() %>% rowid_to_column()

# reduced to 80% on copy/paste

AR_tb %>%

ggplot(aes(rowid, x)) +

ylab("Growth (%)") +

theme(

text = element_text(family = "Calibri"),

axis.title.x = element_blank(),

axis.title.y = element_text(size = 13, face = "bold", margin = margin(0,10,0,0)),

axis.text = element_text(size = 13, face = "bold")

) +

geom_line(size = 1) +

geom_point(size = 4) +

scale_x_continuous(breaks = seq(1, 10, 1), minor_breaks = NULL) +

scale_y_continuous(labels = scales::number_format(accuracy = 0.01)) +

geom_text(aes(label = x), size = 4, color = "darkgreen", fontface = "bold", nudge_y = 0.2, nudge_x = .62)## Don't know how to automatically pick scale for object of type ts. Defaulting to continuous.## Warning in grid.Call(C_stringMetric, as.graphicsAnnot(x$label)): font family not

## found in Windows font database## Warning in grid.Call(C_textBounds, as.graphicsAnnot(x$label), x$x, x$y, : font

## family not found in Windows font database

## Warning in grid.Call(C_textBounds, as.graphicsAnnot(x$label), x$x, x$y, : font

## family not found in Windows font database## Warning in grid.Call.graphics(C_text, as.graphicsAnnot(x$label), x$x, x$y, :

## font family not found in Windows font database

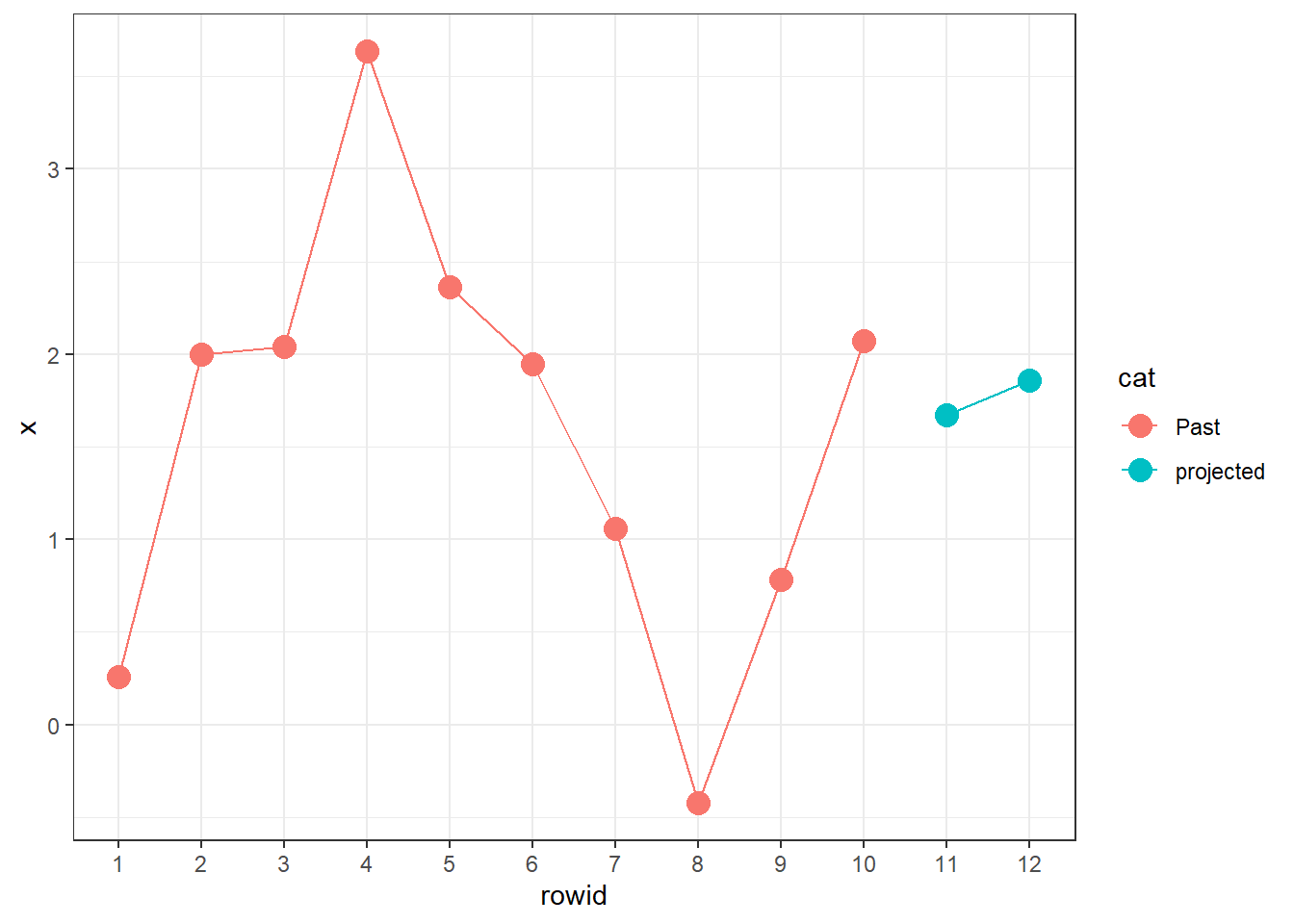

AR[9] # the ts not the tibble## [1] 0.782AR[10]## [1] 2.072AR_11 <- AR_intercept + AR_param_1 * AR[10] + AR_param_2 * AR[9]

AR_12 <- AR_intercept + AR_param_1 * AR_11 + AR_param_2 * AR[10]

AR_tb <- cbind(AR_tb, cat = rep("Past",10))

AR_tb <- AR_tb %>% add_row(rowid = 11, x = AR_11, cat = "projected")

AR_tb <- AR_tb %>% add_row(rowid = 12, x = AR_12, cat = "projected")

AR_tb %>%

ggplot(aes(rowid, x, group = cat, color = cat)) +

geom_line() +

geom_point(size = 4) +

# xlim(0, 13)

# scale_x_discrete(limits = c(0,13), breaks = 1)

scale_x_continuous(breaks = seq(1, 12, 1), minor_breaks = NULL)

AR_11## [1] 1.6706AR_12## [1] 1.856920.25.3. Long-run mean

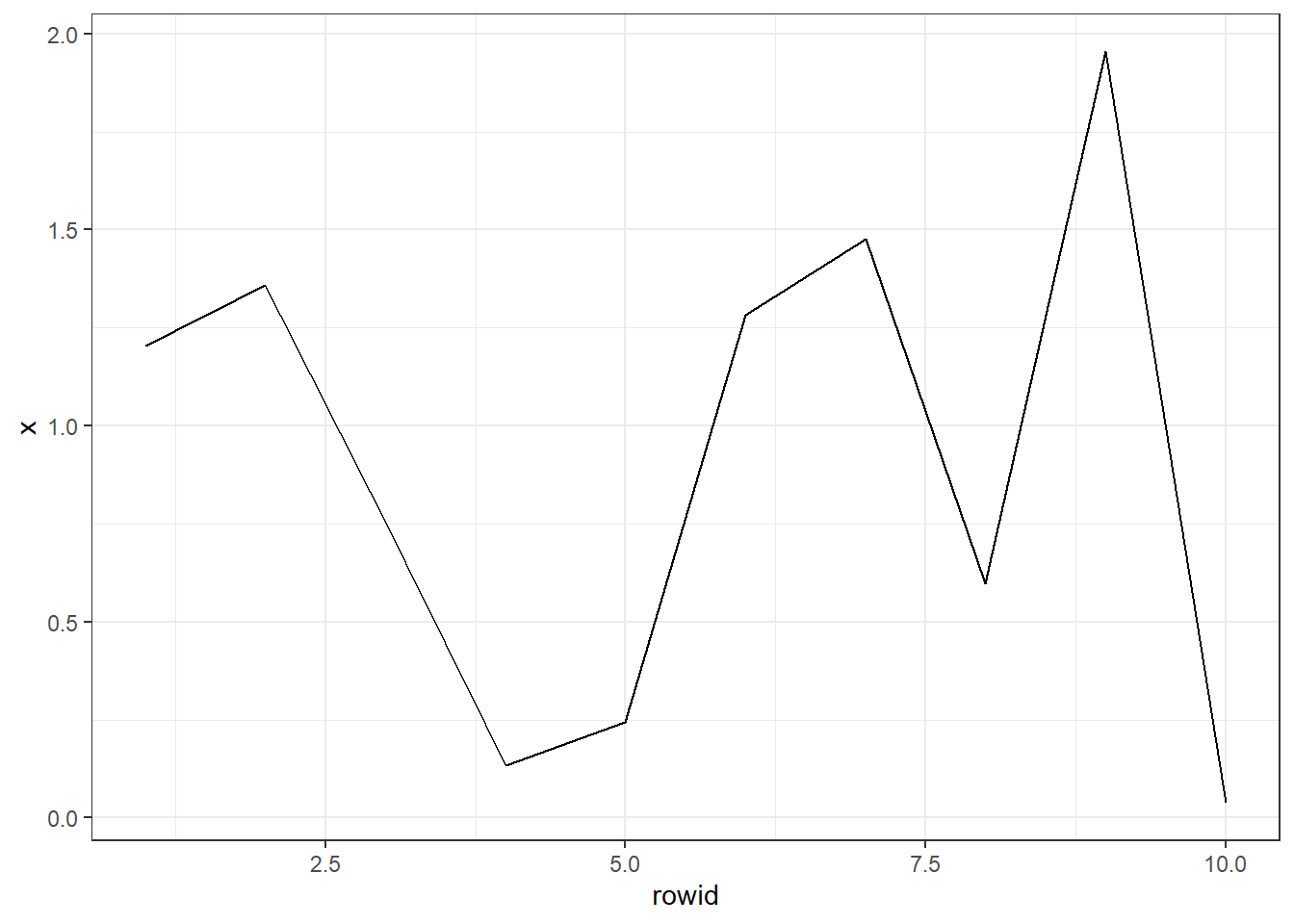

20.25.2.Jennifer is an analyst who is deciding which second-order model to fit to her time series dataset. She prefer to fit either an MA(2) or AR(2) model:

- MA(2): Y(t) = μ + θ(1)ε(t-1) + θ(2)ε(t-2) + ε(t)

- AR(2): Y(t) = ẟ + ϕ(1)Y(t-1) + ϕ(2)Y(t-2) + ε(t)

She is evaluating the models with the same parameters: an intercept of 0.590 and weights of 0.460 and 0.180 such that the two models are specified as follows:

- MA(2): Y(t) = 0.590 + 0.460ε(t-1) + 0.180ε(t-2) + ε(t)

- AR(2): Y(t) = 0.590 + 0.460Y(t-1) + 0.180Y(t-2) + ε(t)

What are, respectively, the long-run (aka, unconditional) means of these two models?

set.seed(22)

AR2_param_1 = 0.460

AR2_param_2 = 0.180

AR2_intercept = 0.590

AR2_n <- 10

theme_set(theme_bw())

# arima.sim model c(p, d, q)

# p = AR order

# d = difference

# q = MA order

# Generate an AR(2) with parameters, AR_param_1 and AR_param_2

# Not this: AR <- arima.sim(model=list(order=c(2,0,0), ar = c(AR_param_1, AR_param_2)), n = AR_n) + AR_intercept

AR2 <- arima.sim(model=list(order=c(2,0,0), ar = c(AR2_param_1, AR2_param_2)), n = AR2_n, mean = AR2_intercept)

AR2 <- round(AR2, digits = 3)

AR2_tb <- AR2 %>% as_tibble() %>% rowid_to_column()

AR2_tb %>%

ggplot(aes(rowid, x)) +

geom_line()## Don't know how to automatically pick scale for object of type ts. Defaulting to continuous.

AR2_11 <- AR2_intercept + AR2_param_1 * AR2[10] + AR2_param_2 * AR2[9]

AR2_12 <- AR2_intercept + AR2_param_1 * AR2_11 + AR2_param_2 * AR2[10]

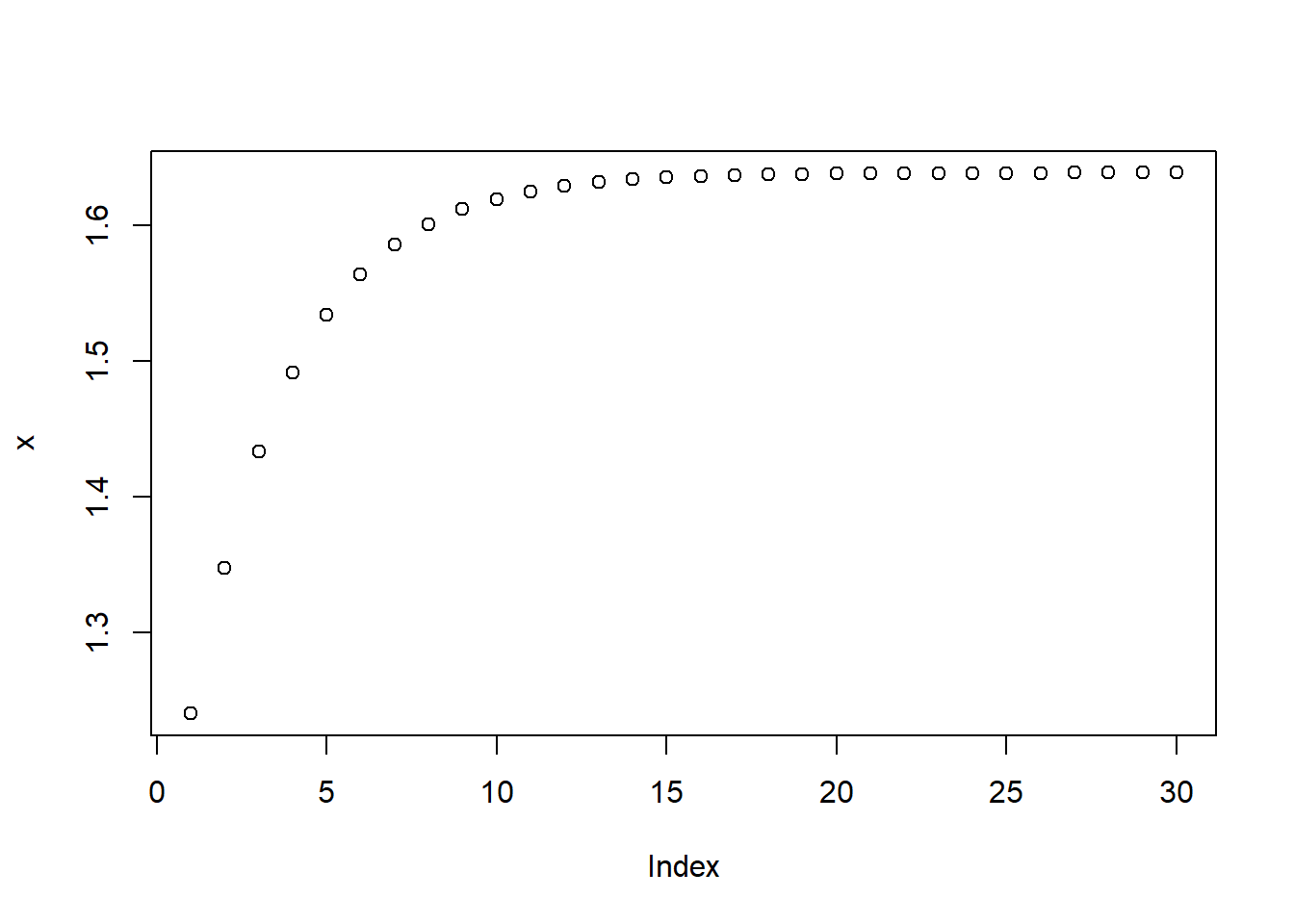

AR2_13 <- AR2_intercept + AR2_param_1 * AR2_12 + AR2_param_2 * AR2_11

AR2_14 <- AR2_intercept + AR2_param_1 * AR2_13 + AR2_param_2 * AR2_12

x = vector(mode= "numeric", length = 30)

x[1] = AR2_13

x[2] = AR2_14

for (i in 3:30) {

x[i] <- AR2_intercept + AR2_param_1 * x[i-1] + AR2_param_2 * x[i-2]

}

plot(x)

AR2_11## [1] 0.95892AR2_12## [1] 1.037763AR2_13## [1] 1.239977AR2_14## [1] 1.347187x[3]## [1] 1.432902x[4]## [1] 1.491628x[5]## [1] 1.534071x[28]## [1] 1.638846x[29]## [1] 1.638858x[30]## [1] 1.638867